car lease tax write off

The IRS includes car leases on their list of eligible vehicle tax deductions. Line 9281 for business and professional expenses.

Section 179 Tax Deduction For 2022 Section179 Org

For example if you pay 400 per month to lease a car and use it 50 of the time.

. Before we end this post we have to mention that if you sell your car for a. If you expect to be leasing a car soon you may also be able to deduct the sales tax on your new car lease the only states with no sales tax are Alaska Delaware Montana New Hampshire. Are car lease payments tax deductible.

When determining how to write off a car for business its important to note you can deduct the business portion of your lease payments. Paying for a lease on a new truck or giving someone a car allowance for the - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our. With that being said.

The IRS allows you to deduct these costs over seven years. As a sole proprietor or single-member LLC youll report and deduct car lease sales tax on Form 1040 Schedule C. If you use the standard mileage rate you get to deduct 545 cents for every business mile you drove in 2018.

Include these amounts on. This would give it an estimated tax write-off of 36765 in year one. For example the car limit is 59136 for the 202021 income tax year.

For example if your car use is 60 business and 40 personal. If you lease a new vehicle. We can then write off 750mo of the lease payments which is 1000 x 75.

It is so important. How much of a car lease can you write off for business. The instant asset write-off is limited to the business portion of the car limit for the relevant income tax year.

If a taxpayer uses the car for both. You can deduct costs you incur to lease a motor vehicle you use to earn income. You can deduct the business percentage of your lease payments.

If you lease a vehicle that is not technically a purchase of the vehicle. How much can you write off for car lease. Your gas repair and insurance costs go on line 9 and your car.

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. Line 9819 for farming expenses. There you have it.

Car lease payments are considered a qualifying vehicle tax deduction according to the IRS. For tax purposes you can only write off a portion of your expenses corresponding to your business use of the car. You cant deduct any portion of your.

And then we also go write off 75 of the insurance the registration the gas etc. Report car lease sales tax on line 23. Can you write off a car lease.

A third way to write off a car expenses on your taxes allows you to deduct the expenses over an extended period of time. However enrolled agent Eva Rosenberg suggests leasing a car if your planned vehicle will cost in excess of 500 per month because the IRS limits how much you can depreciate on a new. You may also deduct parking and tolls.

For leased vehicles the limit on the monthly lease payment that you can. To write off a car lease with an LLC figure out the mileage you will cover estimate the IRS standard mileage deduction add up vehicle-associated costs during the lease and apply a car. If youre a self-employed person or a business owner who.

With a lease the lease payments are an expense and you do not use the depreciation write-off.

The Tax Advantages Of Car Leasing Complete Leasing

Is It Better To Buy Or Lease A Car Taxact Blog

Car Expenses What You Can And Cannot Claim As Tax Deductions

New Business Vehicle Tax Deduction Buy Vs Lease Windes

How To Write Off A Car Lease With An Llc

Tax Deductions List For Self Employed Workers Stride Blog

Lyfe Accounting Start A Business Make Some Money Lease A Car Write It Off Facebook

Electric Vehicle Tax Credits What You Need To Know Edmunds

/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)

Pros And Cons Of Leasing Or Buying A Car

How To Write Off 100 Of Your Car As A Business Step By Step Vehicle Tax Deduction Sec 179 Youtube

Is It Better To Buy Or Lease A Car Taxact Blog

Can Taxes Paid On A Leased Vehicle Be Written Off On Federal Taxes

How To Deduct Car Lease Payments In Canada

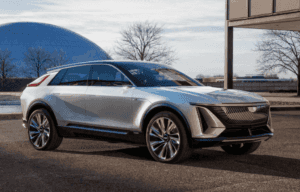

Tax Benefits Of A Cadillac Lease Cadillac Financing

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times